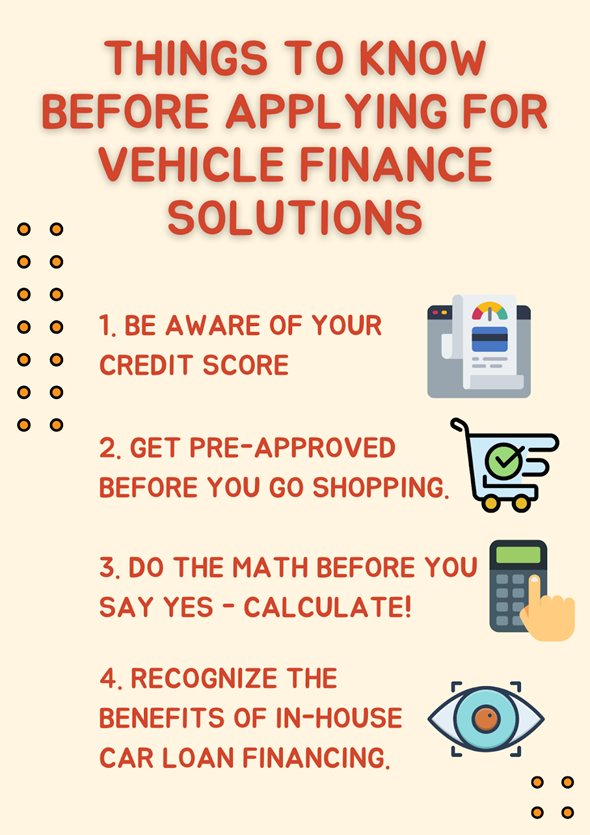

Things To Know Before Applying For Vehicle Finance Solutions

Buying a car is perhaps comparable to owning property or establishing a business. Interest accrues as you repay a loan over time. Hence, you must know your auto loan rates, ideal monthly payment, and responsibilities as a borrower before signing the contract. Read through this article to get you ready to find and drive the car you want with the ideal vehicle finance solution that fits your needs.

1. Be aware of your credit score

Your credit score is an essential aspect that determines everything. This includes your interest rate, loan sum, monthly payment. It also has the approval of your dealer, your credit union, or bank, especially when applying for any loan, such as car loans or the best COE renewal loan.

Because different lenders have varying requirements, the minimum score required to qualify varies based on the company offering the loan. Knowing your credit record will benefit you in obtaining the highest loan amount and the top auto loan rates. Therefore, you will know your chances of gaining credit approval before taking a test drive.

2. Get pre-approved before you go shopping.

It’s usually ideal to go into a car dealership with a pre-approved financing offer from a credit union or bank. A pre-approved offer ensures that you will be able to obtain financing to meet the cost of the vehicle you desire. After you’ve secured auto finance, you can concentrate on selecting a car without worrying about whether you’ll be able to afford the monthly payment.

3. Do the math before you say yes – calculate!

It’s critical to understand the components that go into determining your monthly auto payment when you secure your financing. To play with the figures, use a car loan calculator – whether it’s for a COE renewal financing or car financing options. You might be in a rush to get that automobile off the lot, but spending a day crunching the numbers can save you thousands down the road.

4. Recognize the benefits of in-house car loan financing.

In-house car loan financing may appear to be a more appealing alternative at times. Consider loaning from your dealership and find one that allows you to pay more than the monthly amount to boost your credit score for the following auto loan.

Final Thoughts

Having a finance plan from Swee Seng for your new automobile is a terrific way to get the vehicle you need and want without having to make any unwanted compromises.

Keep these pointers in mind before committing to anything, as the transaction may appear confusing. You’ll feel good about the automobile and your financial status if you do your research, assessment, get pre-approved, and do the initial calculations yourself.